Post by perceptions_now on Jun 21st, 2010 at 5:26pm

Is Global Economic Growth Slowing Already?

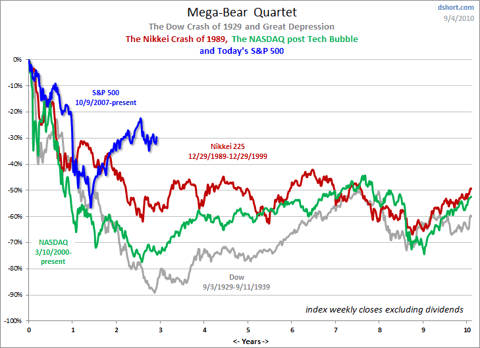

Compared to past economic recoveries, this one has not yet kicked into high gear. Now, I’m starting to wonder if it will. The U.S. economy is growing, but we need growth overseas if we are going to maintain our growth. Unfortunately, Europe is very sluggish and that is not likely to change. Some of the emerging markets such as China and India are still growing, but China’s efforts to dampen inflation will almost certainly slow its economy too. As you can see from this chart from UBS, we have barely gotten going and global growth is already showing signs of slowing down:

In this chart from Thomas Berner, Chief U.S. Economist, at UBS, we can see how sluggish things are around the world.

The blue lines show the actual gross domestic product for the world. The steady gold line seems to refer to an average growth rate over time. During a recession, actual GDP falls below the line, but then in a recovery it shoots above the line. In the past, growth rates for the world’s economy frequently hit 5%, 6% or 7% per year for a while after a recession ended. Not this time.

There are many factors to which I could point, but I think uncertainty over the future is the number one retardant.

Link -

http://seekingalpha.com/article/210898-is-global-economic-growth-slowing-already?source=email

============

There are reasons, why things are not behaving the same, this time -

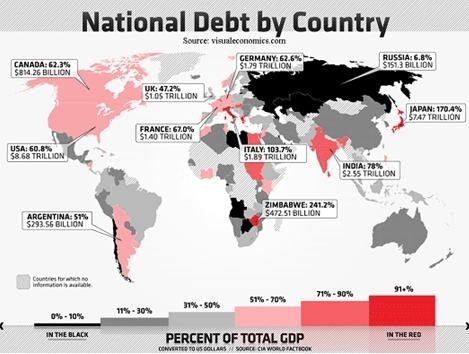

Debt increasing Globally

Enegry Declining Gloablly

Aging Population, set to anchor growth, now.

Population total, set to Decline and anchor Growth, in the longer term.

Compared to past economic recoveries, this one has not yet kicked into high gear. Now, I’m starting to wonder if it will. The U.S. economy is growing, but we need growth overseas if we are going to maintain our growth. Unfortunately, Europe is very sluggish and that is not likely to change. Some of the emerging markets such as China and India are still growing, but China’s efforts to dampen inflation will almost certainly slow its economy too. As you can see from this chart from UBS, we have barely gotten going and global growth is already showing signs of slowing down:

In this chart from Thomas Berner, Chief U.S. Economist, at UBS, we can see how sluggish things are around the world.

The blue lines show the actual gross domestic product for the world. The steady gold line seems to refer to an average growth rate over time. During a recession, actual GDP falls below the line, but then in a recovery it shoots above the line. In the past, growth rates for the world’s economy frequently hit 5%, 6% or 7% per year for a while after a recession ended. Not this time.

There are many factors to which I could point, but I think uncertainty over the future is the number one retardant.

Link -

http://seekingalpha.com/article/210898-is-global-economic-growth-slowing-already?source=email

============

There are reasons, why things are not behaving the same, this time -

Debt increasing Globally

Enegry Declining Gloablly

Aging Population, set to anchor growth, now.

Population total, set to Decline and anchor Growth, in the longer term.