Post by perceptions_now on Feb 6th, 2013 at 1:32pm

The Twilight of Petroleum

This graph, as earlier mentioned, shows that on a global level production of crude oil soon will begin its decline. The forecasts of the IEA contain certain elements which are at the very least “slightly optimistic”, to not say outright fanciful, regarding the expected future production from reservoirs yet to be discovered and developed as well as considerably inflated prospects regarding non-conventional oil

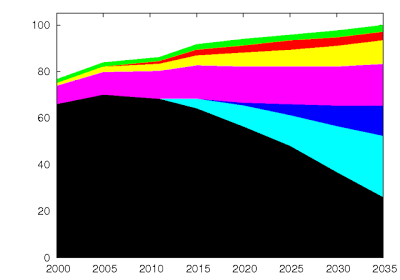

With this as my starting point I prepared a continuous graph (a simple linear extrapolation for the years for which we don’t have data); the colors approximately correspond to those of the IEA graph:

We are adding various categories of hydrocarbons assuming they are equivalent, when in fact, they are not. Non-conventional oils, (all of them) have lower energy densities per volume, and roughly 70% that of crude oil. In addition, the refining improvements refer to the increase in volume of products derived from the refining of petroleum, and such an increase in volume obviously does not assume an increase in the energy which is extracted from the petroleum.

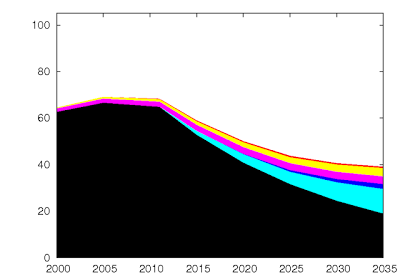

In reality such products contain more energy than that of the original barrel because their processing uses natural gas for the hydrogenation of the less saturated hydrocarbons. What obviously occurs is that the energy of the refined products from a barrel of oil is equal to the energy of the original barrel plus that of the natural gas used in refining it. Making these adjustments (non conventional oils have about 70% of the energy by volume as normal crude oil(*), the improvements in refining do not increase the energy of the petroleum), we then obtain the following graph in millions of barrels of oil equivalents to crude oil per day:

This is the graph which the IEA should have presented if it had counted properly, that is, by reporting energy flows, not volumes. As one easily can see the prospects for an increase in production when expressed in terms of associated energy are much more meager and less attractive: We will go from 79.5 Mb/d (now understood as energy equivalents) in 2011 to 87.5 Mb/d in 2035.

To do an estimate of the net energy we need to know the EROEI (Energy Returned on Energy Invested) of the various sources of hydrocarbons mixed in with the petroleum.

EROEI = Te/Ep

Where Te is the total energy produced by a source and Ep is the energy required for its production with both taken over the entire usable lifetime of the source in question.

With this formulation, the net energy En which an energy source delivers during its useful life (and if we have many sources at different moments of their useful lives it is equally valid as a snapshot of the whole) is:

En = Te - Ep = Te x (1 – 1/EROEI)

Here are my own values;

+ For crude oil presently in production I assume an EREOI value of 20

+ For the more expensive crude oil which is not being extracted I assume an EROEI of 5.

+ For the petroleum which is yet to be discovered I assume an EROEI of 3

+ For non-conventional petroleum, including shale oil, I assume an EROEI of 2

+ Regarding shale oil, we have indicated already that these estimates are very inflated. I reduce them by half.

With these premises, the graph of net energy that we obtain is as follows:

We know already that classic economic education cannot recognize the concept of EROEI and therefore the explanation which will be given when petroleum production will decline, will be that there is insufficient investment in exploration and development

The final fact is that the petroleum era has come to its end. Our epoch of accelerated economic development based on inexpensive petroleum is already over.

Link -

http://www.resilience.org/stories/2013-02-05/the-twilight-of-petroleum

==============================

The other big Fossil fuel, being Coal, is now also headed down a similar path!

Of the 3 great Economic drivers, 2 are already in relative Decline, prior to going into absolute Decline.

Both Population & Energy Growth are already slowing & have been for some time, BUT the relative effects started becoming apparent for Energy issues around 2000, whilst the Demographic issues followed around 2006.

These major Economic drivers are already slowing, prior to going into reverse. Japan is the Canary in the Coal mine, so to speak & no Politician (Left or Right) can simply "wish" these issues away.

No matter what any Politician may say, the next 20 years will be nothing like the last 20 years, with Economic Growth slowing, before going into actual Decline and no amount of government or Central Bank action/s will prevent that from happening.

If any Politician says any different, you have my permission, to tell him or her, that they are inept or lying & they have NFI.

Both the Public & Politicians need to face Reality & we need to do it now!

This graph, as earlier mentioned, shows that on a global level production of crude oil soon will begin its decline. The forecasts of the IEA contain certain elements which are at the very least “slightly optimistic”, to not say outright fanciful, regarding the expected future production from reservoirs yet to be discovered and developed as well as considerably inflated prospects regarding non-conventional oil

With this as my starting point I prepared a continuous graph (a simple linear extrapolation for the years for which we don’t have data); the colors approximately correspond to those of the IEA graph:

We are adding various categories of hydrocarbons assuming they are equivalent, when in fact, they are not. Non-conventional oils, (all of them) have lower energy densities per volume, and roughly 70% that of crude oil. In addition, the refining improvements refer to the increase in volume of products derived from the refining of petroleum, and such an increase in volume obviously does not assume an increase in the energy which is extracted from the petroleum.

In reality such products contain more energy than that of the original barrel because their processing uses natural gas for the hydrogenation of the less saturated hydrocarbons. What obviously occurs is that the energy of the refined products from a barrel of oil is equal to the energy of the original barrel plus that of the natural gas used in refining it. Making these adjustments (non conventional oils have about 70% of the energy by volume as normal crude oil(*), the improvements in refining do not increase the energy of the petroleum), we then obtain the following graph in millions of barrels of oil equivalents to crude oil per day:

This is the graph which the IEA should have presented if it had counted properly, that is, by reporting energy flows, not volumes. As one easily can see the prospects for an increase in production when expressed in terms of associated energy are much more meager and less attractive: We will go from 79.5 Mb/d (now understood as energy equivalents) in 2011 to 87.5 Mb/d in 2035.

To do an estimate of the net energy we need to know the EROEI (Energy Returned on Energy Invested) of the various sources of hydrocarbons mixed in with the petroleum.

EROEI = Te/Ep

Where Te is the total energy produced by a source and Ep is the energy required for its production with both taken over the entire usable lifetime of the source in question.

With this formulation, the net energy En which an energy source delivers during its useful life (and if we have many sources at different moments of their useful lives it is equally valid as a snapshot of the whole) is:

En = Te - Ep = Te x (1 – 1/EROEI)

Here are my own values;

+ For crude oil presently in production I assume an EREOI value of 20

+ For the more expensive crude oil which is not being extracted I assume an EROEI of 5.

+ For the petroleum which is yet to be discovered I assume an EROEI of 3

+ For non-conventional petroleum, including shale oil, I assume an EROEI of 2

+ Regarding shale oil, we have indicated already that these estimates are very inflated. I reduce them by half.

With these premises, the graph of net energy that we obtain is as follows:

We know already that classic economic education cannot recognize the concept of EROEI and therefore the explanation which will be given when petroleum production will decline, will be that there is insufficient investment in exploration and development

The final fact is that the petroleum era has come to its end. Our epoch of accelerated economic development based on inexpensive petroleum is already over.

Link -

http://www.resilience.org/stories/2013-02-05/the-twilight-of-petroleum

==============================

The other big Fossil fuel, being Coal, is now also headed down a similar path!

Of the 3 great Economic drivers, 2 are already in relative Decline, prior to going into absolute Decline.

Both Population & Energy Growth are already slowing & have been for some time, BUT the relative effects started becoming apparent for Energy issues around 2000, whilst the Demographic issues followed around 2006.

These major Economic drivers are already slowing, prior to going into reverse. Japan is the Canary in the Coal mine, so to speak & no Politician (Left or Right) can simply "wish" these issues away.

No matter what any Politician may say, the next 20 years will be nothing like the last 20 years, with Economic Growth slowing, before going into actual Decline and no amount of government or Central Bank action/s will prevent that from happening.

If any Politician says any different, you have my permission, to tell him or her, that they are inept or lying & they have NFI.

Both the Public & Politicians need to face Reality & we need to do it now!