Title: Put GST On Private Health Insurance Not Fresh Food

Post by imcrookonit on Jan 8th, 2015 at 5:05am

Put the GST on private health insurance and private schools, not fresh food

Date

January 8, 2015

The Age

Food for thought: Health experts have raised fears that applying the GST to fresh food will worsen rates of obesity and chronic disease.

The Abbott government should apply the GST to private health and education, rather than fresh food, if it wants to raise more revenue with the tax, according to research from think tank The Australia Institute.

That would help to raise an extra $2.3 billion a year, and it would be less regressive than applying the GST to fresh food because it would affect predominantly middle- and high-income households. :)

The Abbott government has kickstarted debate on raising the GST this week with Country Liberal MP Dan Tehan saying the tax should be broadened to cover items such as fresh food, education and health. :(

Country Liberal MP Dan Tehan sparked debate on raising the GST this week, saying the tax should cover fresh food, education and health.

By broadening the GST it would raise $21.6 billion in extra revenue each year and enable further serious reductions in direct taxes, Mr Tehan has argued.

But health experts have slammed suggestions the GST should apply to fresh food, warning such a change would worsen already alarming rates of obesity and chronic disease.

Australia's farmers have also criticised the move, saying big supermarkets would push the costs onto farming families, and consumers would switch to less healthy and cheaper processed foods. :(

In a new paper, called How to Extend the GST without Hurting the Poor, Australia Institute economist Matt Grudnoff has argued that the government could make the GST less regressive while raising more revenue at the same time.

"[And] this could be achieved by removing the GST exemptions for services that are more likely to be consumed by higher-income households," Mr Grudnoff argues.

"The two prime candidates for consideration are private schools and private health insurance." :)

Drawing on work by the National Centre for Social and Economic Modelling (NATSEM), the paper shows the government would raise an extra $1.5 billion a year from a GST on private health insurance and $790 million from private schools.

Most of that money would come from families living in capital cities, rather than regional areas.

"The criticism of the Abbott government's first budget was that it was unfair," Mr Grudnoff says in the paper.

"Analysis of the budget from a number of different sources, including Treasury, showed that the budget savings were built on taking money from those on lower incomes far more than those on higher incomes." :(

"A broadening of the GST to include private schools and private health insurance is less likely to be subject to similar criticism, since most of the tax revenue will come from higher-income earners." ;)

Earlier this week, the Grattan Institute think tank said if the government put a GST on fresh food it would raise an extra $6 billion a year.

Assistant Treasurer Josh Frydenberg suggested recently that the GST should be applied to goods bought from overseas websites that are worth less than $1000, but he has been criticised by members of his own party for doing so.

But Foreign Minister Julie Bishop said on Wednesday that she supported all MPs who wanted to talk about ways to reform the GST.

"I certainly supports MPs for putting forward ideas," Ms Bishop said.

"We should have a constructive, mature debate about our taxation system and that would include the GST."

The executive director of the Institute for Public Affairs, John Roskam, urged the government to drop talk of new taxes and stand up for consumers instead.

"The membership understands the cost pressures on individuals and families and it is a terrible message at the start of 2015 for the federal government to be talking about increasing costs for families and increasing taxes when they should talking about doing the opposite," he said.

Mr Roskam said extending the GST to online purchases - the move flagged by Mr Frydenberg this week - would increase the cost of living for families for little revenue gain. :(

"It will be a pin-prick to allegedly help save the retailers when they have far bigger problems," Mr Roskam said.

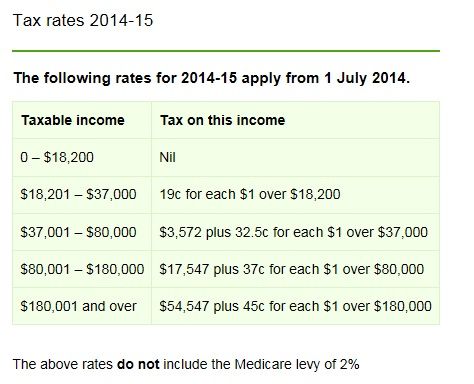

The GST raises about $54 billion in revenue for the federal government each year, before being distributed to the states.

|

crazxy-carnal_004.jpg (46 KB | 48

)

crazxy-carnal_004.jpg (46 KB | 48

)