Post by Unforgiven on Oct 7th, 2016 at 10:17am

The British Rupiah plunges!

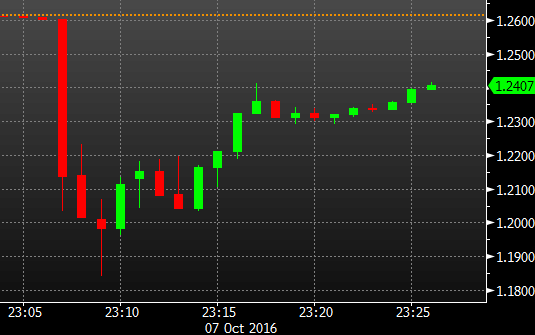

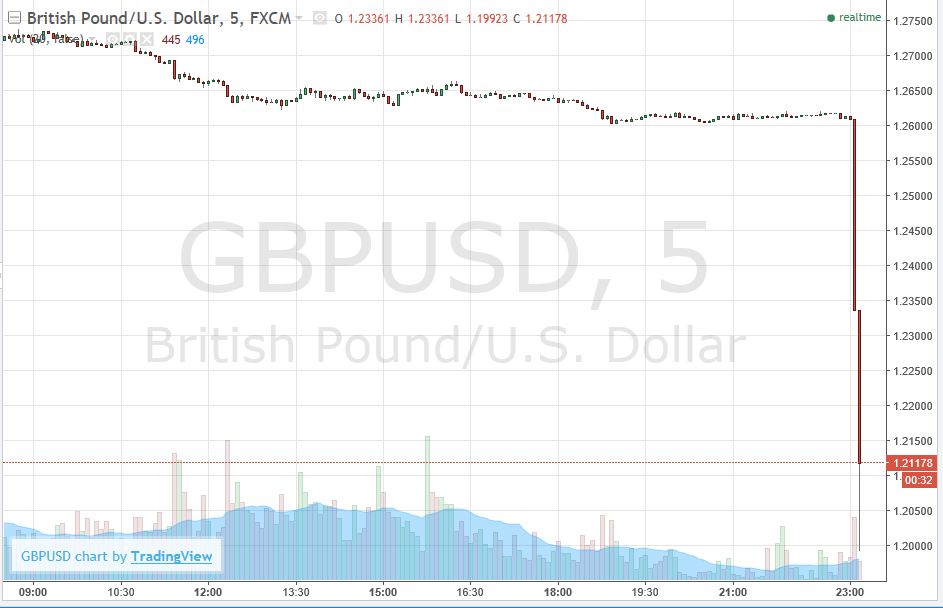

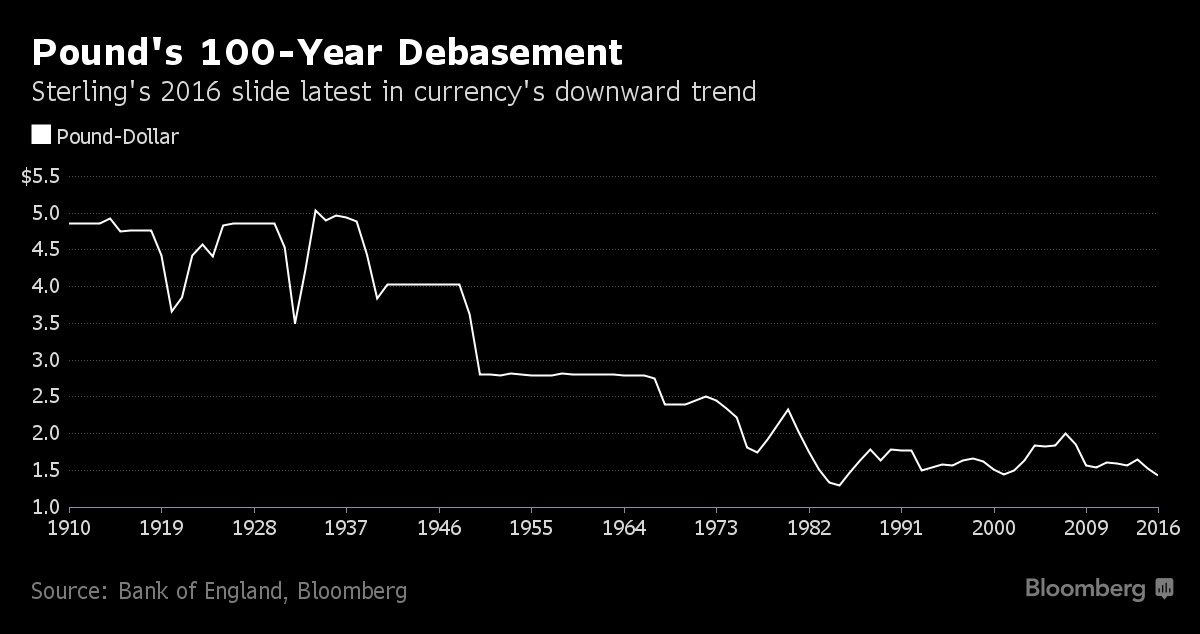

That's a huge drop in exchange rates rarely seen in currencies other than Zimbabwe's. It could have gone lower than 1.2 except for trading stops which were triggered.

French president Hollande enjoyed himself sticking the boots into UK.

It got as low as US$ 1.2 overnight.

http://news.forexlive.com/!/gbp-plunge-hollande-gets-the-narrative-prize-20161006

Quote:

That's a huge drop in exchange rates rarely seen in currencies other than Zimbabwe's. It could have gone lower than 1.2 except for trading stops which were triggered.

French president Hollande enjoyed himself sticking the boots into UK.

It got as low as US$ 1.2 overnight.

http://news.forexlive.com/!/gbp-plunge-hollande-gets-the-narrative-prize-20161006

Quote:

|