freediver wrote on Feb 20th, 2025 at 10:09am:

Bobby. wrote on Feb 19th, 2025 at 8:15pm:

freediver wrote on Feb 19th, 2025 at 4:28pm:| Just to clarify Bobby, you have to actually read it. |

|

Does reading dozens of articles on the web and watching dozens of videos on YouTube about

the fractional banking system count? :-/ |

|

No. |

|

I'm an amateur economist.

We are $1.2 trillion in Federal debt

http://australiandebtclock.com.au/The problem is that money needed for hospitals and schools etc

is used to pay down interest and then the Govt borrows more to

make up the difference they need so we are in a never ending debt spiral.

The Govt spends more than they receive so they put up taxes or

bracket creep helps them too.

It's my understanding that the extra money is created by the Govt

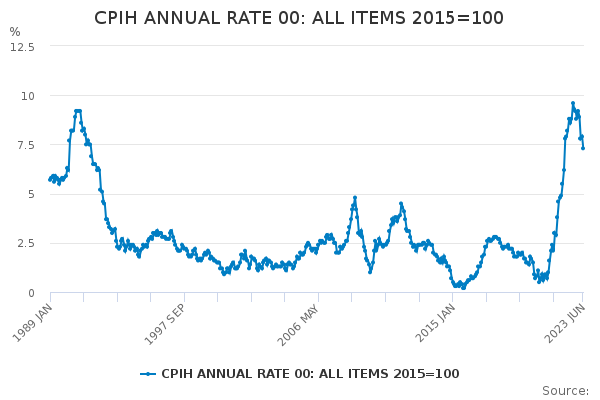

issuing Govt Bonds and the RBA printing money to pay for them.

That causes high inflation and robs the savings of people

who have money in the bank.

Also – people who have money in the bank get charged tax on the interest they made

but no allowance is made for inflation -

so they can actually lose buying power and pay taxes on a non-existent profit.

f8eea062c80dafb3b30e598f486bc724.png (22 KB | 4

)

f8eea062c80dafb3b30e598f486bc724.png (22 KB | 4

)