Does Our Aging Society Mean The End Of Big Growth In The United States?

Summary Most of the wealth in the US, approximately $13.9 trillion, is held directly or on behalf of people over the age of 60.

By 2020, 75 million people will be over 60 (24% of the population).

What does this mean for US economic growth?

Sometimes the biggest changes happen so slowly that people don't notice them.Although it is widely known that people are living longer and that the baby boomers are retiring, few are talking about how monumental the demographic changes are and how these changes affect everything -- business, government, culture, and international policy.

Economically, our aging society may permanently lower the growth rate of the United States.

Demographics are the motors of history and economies.

Economists know that US labor participation rates are the lowest in 38 years, the lowest since the 1970s economic malaise under President Carter.

Various sources, such as the Congressional Budget Office, attribute about half of the decrease in growth to aging workers choosing to exit the workforce. But could our aging population have an even greater negative effect on growth?To put it in perspective, during the Great Depression in the 1930s, about 6 million Americans were over the age of 65 (5.3% of the whole US population at the time). By 2020, 75 million people will be over 60 (24% of the population).We know that risk-taking, entrepreneurship, and overall rates of innovation decline with age. The older you are, the less likely you are to invest in riskier growth assets, start a business, or invent something.

Most of the wealth in the nation, approximately $13.9 trillion, is held directly or on behalf of people over the age of 60.Perhaps this dynamic helps explain why the Federal Reserve is having such a difficult time motivating the broader financial community to invest in small business and growth enterprises.

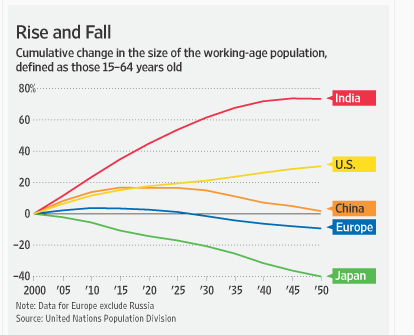

The few countries with even slower growth rates than the United States are Japan and in Europe, where societies are seeing even more extreme aging. In Japan, where populations have shrunk for the third straight year, more people pass on than are born.

In the coming decades, Europe and Japan will see their working-age populations shrink by 30 million and 37 million respectively.

If an aging society is the prime driver of diminished growth (i.e., the "new normal"), then many of our current fiscal and monetary policies will continue to have limited impact.

http://seekingalpha.com/article/2856486-does-our-aging-society-mean-the-end-of-b...========================================================

A few observations -

1) As I have said previously, Demographics is the Economic Motor of the World!

2) The Demographic Growth trend of the world, in particular of the last 200 years, is now changing, as the Global Population first Ages over the next 10-20 years and then actually starts to Decline thru until the end of this century.

3) The major effect of these Demographic changes, will be a steady Demand Decline, over many decades and with that goes an actual Decline in Economic Growth, due to the larger % of older 65 years + (increased by about 10%) and a reduction in younger 0-15 years (decrease by about 10%), over the last 40 years or so.

4) However, there are also other factors, which are also influencing events, including Energy Supply & Pricing AND Climate Change.

Both of these additional factors, will prevent a simple repeat of the last Baby Boom, to rectify our current Economic problems, as a lack of Food & Water, plus a lack of cheap & available Energy Supply means that continued actual Global Population Growth is now an IMPOSSIBILITY!

5) So, we can't go forward & we can't go back, at least we can't do so, in the usual manner of firing up the Demographic Engine of the Economic World!

What we will have to do, is change and the changes must start now and they must start with Politics!

What we can do,is to change Government Revenue & Expenditure streams, with fair adjustments across all sectors.

But all sectors must be involved or the final outcome/s will please none!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: