A Picture is worth a thousand Words

What does it all mean -

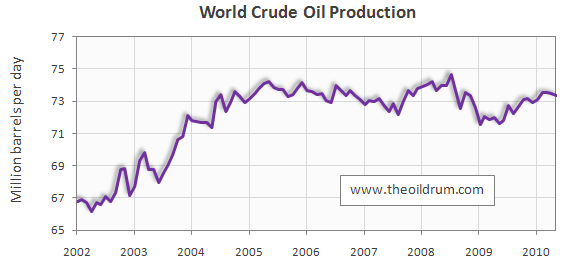

1) World Crude Oil Production effectively Peaked in 2005.

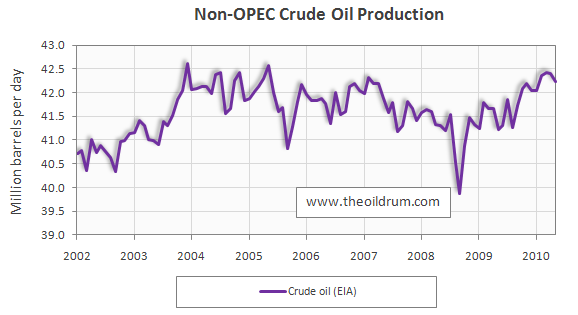

2) Non-OPEC Proction has effectively reduced over the last 7 years, despite a huge ramping up in Russian Production, which is now set to decline.

3) Crude Oil available for export is set to seriously decline over the next 10 years, despite continued Population & Demand increases, which will lead to heavy competition for available resources and a continued escalation in Oil Pricing, which will also drag up other Energy pricing!

However, this is only one of the major factors driving the Global Economy, the broader Economy will also have to take into consideration -

1) The effects of an Aging Baby Boomer generation, which are set to commence "official retirement" from January 1st, 2011, which means a decrease in Demand for a wide range of Products & Services, an increase in Taxes from those still employed to pay for the Boomers Pensions and Health Costs that have already been spent by 40 years of Politicians thinking the future would take care of itself.

2) The effects of the continuing slow down in Global Population Growth, which has been slowing for 40 years and is likely to hit ZPG around 2040-2050, before going into actual decline for the rest of this century, which means a slowing Growth in Demand for a wide range of Products & Services.

3) The effects of Global Climate Change, which can be hinted at by the increased prices for Wheat arising from the likes of the Russian summer Heatwave & the Australian summer Floods and increasing Oil costs!

http://chart.apis.google.com/chartchtt=Wheat,+US,+(Hard+Red+Wheat)++price+chart&chts=000000,12&chs=700x420&chf=bg,s,ffffff|c,s,ffffff&chxt=x,y&chxl=0:||2000|2001|2002|2003|2004|2005|2006|2007|2008|2009|2010|1:||1:|84.1|105.1|188.8|272.4|356.1|439.7&cht=lc&chd=t:24,25,24,24,26,26,25,25,27,29,29,29,30,29,30,29,31,29,28,28,28,28,28,28,28,28,28,28,28,30,34,37,43,43,40,37,34,34,32,32,32,30,30,34,33,34,37,38,38,37,38,38,37,35,34,32,34,34,36,35,35,34,34,32,33,32,33,34,36,38,37,37,38,41,40,41,44,44,46,43,45,48,48,46,45,45,45,45,45,51,54,59,74,76,73,84,84,97,100,82,75,79,75,75,67,54,52,50,54,51,53,53,60,58,51,48,43,45,48,47,46,44,43,44,41,36,45,56,62,61,62&chdl=($/mt)&chco=000099&chls=3,1,0

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: