Trends In The Cost Of Energy

Energy is the largest component of the world's Gross Domestic Product. It is a measure of our state of civilization. Its availability determines our standard of living, but also threatens to undermine it: the excessive use of stored energy through burning fossil fuels is a cause of Climate Change. Now, the depletion of these fuels will force us to reinvent how we can continue to advance our civilization in a sustainable manner.

The phenomenon of climate change was identified first in the nineteenth century. By the end of the twentieth century, a consensus evolved in the scientific community as well as among progressive political establishments about the need to limit global warming, but a global response has proved elusive until now.

Over the last half century a number of significant changes to our energy outlook have emerged. In 1949 M. King Hubbert, an Exxon engineer, predicted that oil production in the US would peak in 1971.

This prediction was correct within days. The Global Hubbert's peak (GHP) has been followed by a decline in fossil fuel reserves.

Comparison of Various TechnologiesThe technologies we will compare in this article are nuclear, coal, oil, and natural gas; and solar PV and wind among the renewable options.

Nuclear PowerThe politically most sensitive energy source is nuclear. In recent years, bowing to public wishes, Germany has decided to shut down all nuclear facilities. Two years after the Fukushima accident, Japan is still uncertain about restarting its reactors. Chernobyl and Three Mile Island all are within recent memory.

Nuclear power does not emit any carbon containing gases, so it does not contribute to climate change. Operating in principle for 24 hours, it is a suitable power source for clean base load electricity. Sources of concern are accidents and the unresolved issues of disposal of spent fuel and decommissioning nuclear power stations at the end of their life

When the first nuclear reactors were built, proponents declared that nuclear power would be too cheap to meter. It did not turn out that way. Today, it is difficult to understand the true cost of nuclear power. A first reference represents a most optimistic view of nuclear power. This paper created enough interest that there has been an ongoing discussion since it was first published on April 2 2010. The conclusion of the paper is that the cost of nuclear power is under $0.04 per kWh. The value of nuclear power shown on Figure (3) before 2000 shows this number. This analysis does not adequately take into account the concerns expressed above about nuclear power.

A further reference comes from the experience of the most active player in the nuclear power industry, Electricite de France (EDF). EDF has built and operates the largest number of nuclear power stations in the world. In the reference quoted they announce more than a factor of three cost overruns on the Flamanville plant. The plant now is planning to start operation in 2016 and forecasts $0.12/kWh electricity cost.

It is difficult to arrive at a reliable cost of nuclear electricity. The best numbers I can extract is an average price of $0.10/kWh for 2010, and $0.12/kWh for 2020. The general conclusion of the experts is that nuclear power will not represent more than the present fraction in the electricity mix (presently at below 20% in the US).

Fossil Fuels

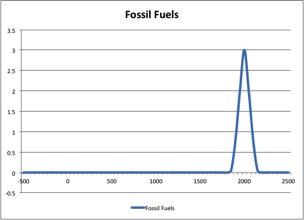

Figure 1. Timeline of the usage of fossil fuels

Figure 1) is a dramatic representation of the time line of the history of the use of fossil fuels.

The peak of the bell shaped curve, representing Huppert's peak, falls close to the year 2000. The half width of the blip is 100 to 200 years, making it imperative that we find an alternate energy source to fossil fuels in our children's lifetime.Climate Change is principally caused by increased CO2 and other greenhouse gases in the atmosphere, due to man made and all other effects. Increased CO2 leads to an increase in the earth temperature.

CoalCoal is the most abundant stored fossil energy on earth. The estimated extractable reserves are about 1 Trillion tons. There is enough coal to provide power to the globe for more than a century. The US has one of the largest reserves in the world. The problem however is that coal is also largest green house polluter of all the energy sources (Table 1). In 2012 coal was the fuel for 40% of the world's electricity and 26% of the global primary energy. The use of coal for electricity generation in the US is being replaced by natural gas. In 2012, for the first time the generation of electricity by natural gas was equal to the electricity generated by coal.

At a price of $30 per ton, the cost of electricity generated by coal is about $0.03 per kWh. The price of coal today can reach $150 per ton. At these prices the cost of natural gas generated electricity becomes competitive with that generated by coal. These cost calculations do not include the cost of externalized environmental and health costs, which amount to about $0.14 per kWh for coal.

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: