Economics, The Art Of Deception Vs. Demographics, The Simple (Yet Ugly) Reality

SummaryPopulation growth is the main driver of economic growth, and population growth is ending in developed nations and slowing in developing nations.

As core 16-54 year old population growth ends, oil consumption has peaked and declined indefinitely, indicating slowing economic activity.

Interest rate cuts and debt are substituted for decelerating population growth... but population growth is not coming back in our lifetime

. Thus, how will ever fewer repay ever more debt?The Federal Reserve's economic ineptitude has likely resulted in a self-reinforcing negative cycle of deflation, depression, and depopulation with unknowable depth, duration, and collateral damage.

World Population Growth is Decelerating From the Bottom UpI'll make what is somehow an objectionable claim among economists...

the world is finite

.

So, a financial and economic system premised on infinite growth and returns was an absurd concept to begin with. However, the absurdity isn't reached until a finite limit is hit. Many believed it would be a resource-driven limit, such as peak oil or peak fresh water. But alas, the resource limit the world is hitting is consumer growth, also known as population growth.The quantity and quality of population growth is primarily what one needs to know to understand changes in global demand and subsequent supply. To understand a global or national economy, quantity (number of participants or population) plus quality (income, savings, plus leverage or credit) tells the story.

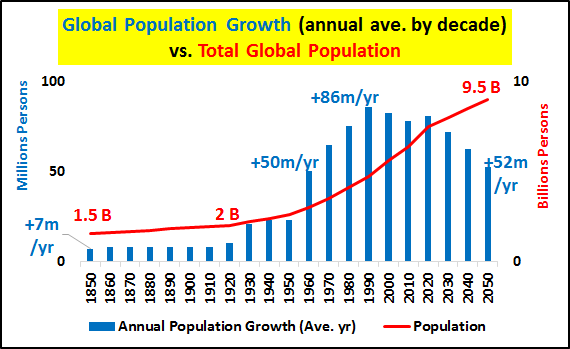

Still, the tiny marginal change in population (in relation to the total population) has impacts magnitudes larger than the numbers suggest. Population growth is the primary driver for all increases in demand, from housing, to cars, to consumer goods, to large infrastructure build-ups to accommodate all these.Quantity of GrowthPopulation growth is pretty much the nexus of all GROWTH. Funny, we hear so little about demographics and yet so much about growth?!?

Annual global population growth peaked in the 1980s, and by 2050, is set to decelerate back to the same gross growth as in the 1950s (despite a total population three times larger than that of the 1950s).

Quality of Growth

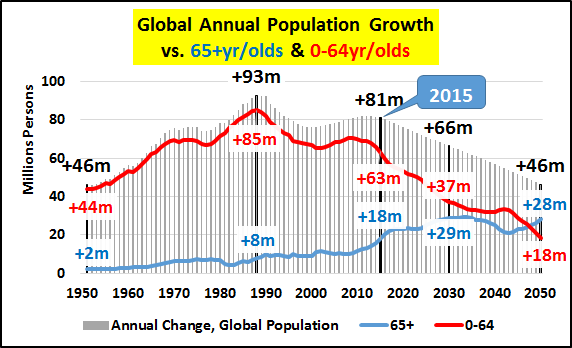

Quality of GrowthThe chart below shows both total global growth and a breakdown by 0-64 year olds versus those in the 65+ year old category. Growth in the 0-64 year old segments represents true population growth (incoming births over outgoing old... 65+), while 65+ growth represents those living longer, thanks to improved medicine, nutrition, fewer wars, etc.

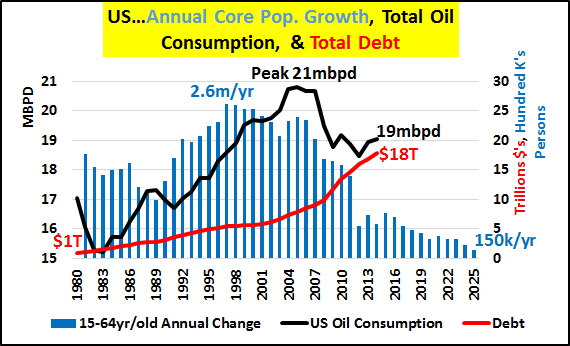

Population Growth Ends... Oil Consumption Peaks and Declines in SympathyWhen the 15-64 year old core population growth peaks, stalls, and or outright declines, oil consumption falls (despite overall populations continuing to grow).

Population Growth Ends... Oil Consumption Peaks and Declines in SympathyWhen the 15-64 year old core population growth peaks, stalls, and or outright declines, oil consumption falls (despite overall populations continuing to grow).  The Fed Made the Inevitable Transition into a Catastrophe

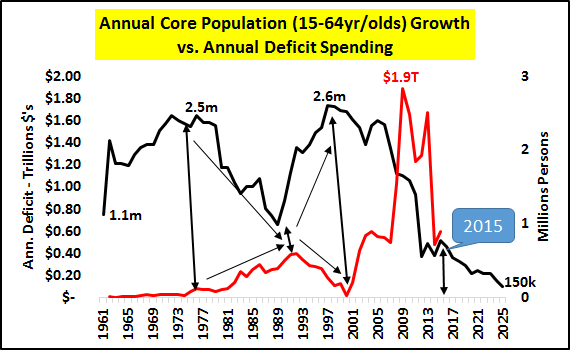

The Fed Made the Inevitable Transition into a CatastropheI have gone a fair ways to outline that population growth was a limited feature that is now coming to an end.

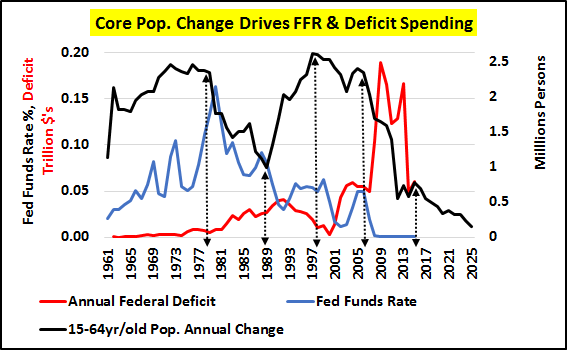

Central banks' models premised on the fallacy that this is a cyclical downturn rather than the structural revolution from high population to low/no population growth are entirely mismanaging fiscal and economic policy.The chart below makes it plain that US federal deficit spending (and periods of slowing economic growth) has been used to offset what are simply periods of slow core population growth.

ConclusionSlowing population growth, particularly among the under-65 crowd, is the malady that afflicts the economic and financial world, and is the reason central banks are now doing back-flips to sustain the unsustainable system they created. However, now debt is maxed out and massive Fed interest rate-created overcapacities are resulting in deflationary and depressionary economic activity, meaning a self-reinforcing negative cycle is underway, of which the depth, duration, and collateral damage are simply unknowable.

ConclusionSlowing population growth, particularly among the under-65 crowd, is the malady that afflicts the economic and financial world, and is the reason central banks are now doing back-flips to sustain the unsustainable system they created. However, now debt is maxed out and massive Fed interest rate-created overcapacities are resulting in deflationary and depressionary economic activity, meaning a self-reinforcing negative cycle is underway, of which the depth, duration, and collateral damage are simply unknowable.Typically, a recession or depression would rebalance supply with demand, but this has always been amid population growth and the rising demands of this new, larger populace. In this case, demand is likely to continue falling indefinitely with falling populations. This means supply will need to consistently shrink until some equilibrium is found.

Central banks are representing the greatest and wealthiest among us, and are "all in" on the perpetuation of this Ponzi.

http://seekingalpha.com/article/3590996-economics-the-art-of-deception-vs-demogr...==========================================

Nuff said!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: