Growth Ain't What It Used To Be And Won't Be Coming Back Anytime Soon... Here's Why

SummaryPopulation Growth is the greatest factor in growing consumption and GDP growth.

Over the past 4yrs, the US Census has downgraded US population growth drastically.

Almost the entirety of the population downgrades have been among the future younger population segments...the impacts for unfunded SS, Medicare, and so much more has gotten so much worse.

Growth is all about greater flow, not stock. Said otherwise,

growth in consumption and GDP generally happens via population growth, wage growth, and/or credit growth...the greatest being population growth.

So, in that context, the below probably matters (a lot).

In 2008, the US Census Bureau projected strong population gains through 2050 helping to drive growing consumption and US economic growth. The projected population growth was generally balanced across age segments primarily driven by gains in young Hispanics due to higher birth rates and immigration.

But in 2012, in a story here the Census acknowledged that these were bad assumptions as these trends were not continuing, as had been expected.

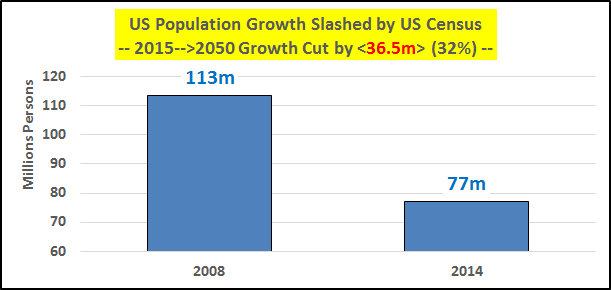

In December of 2014, again here, the US Census affirmed and further downgraded it's population projections from 2012. The Census now anticipates a 32% reduction from it's previous 2008 projections for US population growth from 2015 to 2050 (or about 36 million fewer Americans...chart below).

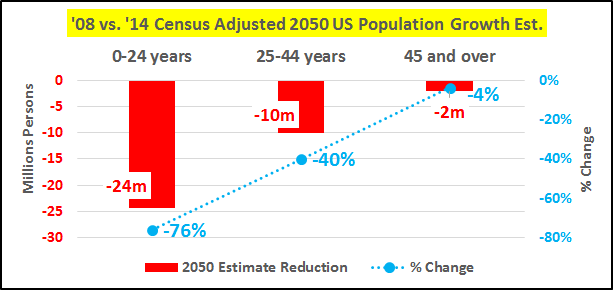

The US is still projected to grow by 77m but significantly less than the previous estimate of 113m. 95% of the cuts to the population growth are in the under 45yr/old population. As the chart below highlights, the cuts among the 0-24 and 25-44 populations were massive...the change in growth among the 45 and older miniscule.

The chart below highlights the reductions in population growth across the age segments, and as mentioned above, the 0-24yr/old population growth was slashed by 76% or 24 million fewer youth and 40% fewer 25-44yr/olds.

That this isn't front page news is, I suppose, a sign of the times. GDP and potential economic growth estimates weren't ratcheted back to match the huge slowdown in young vs. continuing growth among older populations. For those wondering when economic growth will be getting back to "normal"...the US Census has made it clear there is a "new abnormal"...in the new abnormal population growth is among the old. Little to no growth among the young. Wage growth is next to nil. The only hope for those awaiting "trend" growth is another doubling or tripling of credit / debt every seven years or so to move the needle along. Never mind that's pretty much next to impossible without the wheels coming off the cart.

For those wondering when economic growth will be getting back to "normal"...the US Census has made it clear there is a "new abnormal"...in the new abnormal population growth is among the old. Little to no growth among the young. Wage growth is next to nil. The only hope for those awaiting "trend" growth is another doubling or tripling of credit / debt every seven years or so to move the needle along. Never mind that's pretty much next to impossible without the wheels coming off the cart.Welcome to the new abnormal which the Fed, Federal .Gov, nor Wall St. will acknowledge. And if our leadership won't even acknowledge there is a problem, we can take none of the necessary though painful steps to begin a resolution.

http://seekingalpha.com/article/3782536-growth-aint-what-it-used-to-be-and-wont-...==============================================

A few observations -

1) It is not only the US Government & Central Banker, that would even acknowledge there are issues here, let alone acknowledging there are Problems, let alone acknowledging those Problems are "once in history" and they definitely are not going near the fact that these Problems do not have "auto solutions", like those administered to the usual Business cycle ups & downs!

2) The issues raised here, do not just apply to the USA, they are pretty much Global, with some variations AND THE FLOW ON EFFECTS ARE & WILL BE ENORMOUS!

3) The US Census is still not "coming clean" with the full likely outcomes AND they are MILES OUT on the 45 & over estimates, as pretty much ALL OF THE MILLIONS (usa)/BILLIONS (GLOBAL) of BABY BOOMERS WILL BE DEAD BY 2050!

4) Demographics are not the only MAJOR factor now influencing the Global Economy, with the following also having major impacts -

a) ENERGY - Via Demand, Supply & Pricing!

b) Climate Change - Via Food & Water Supply/Pricing AND impacts on Economic Destruction & increased Debt via the Cost/s of preventing or Repairing Damaged infrastructure & Agriculture.

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: