Startling look at Job Demographics by Age

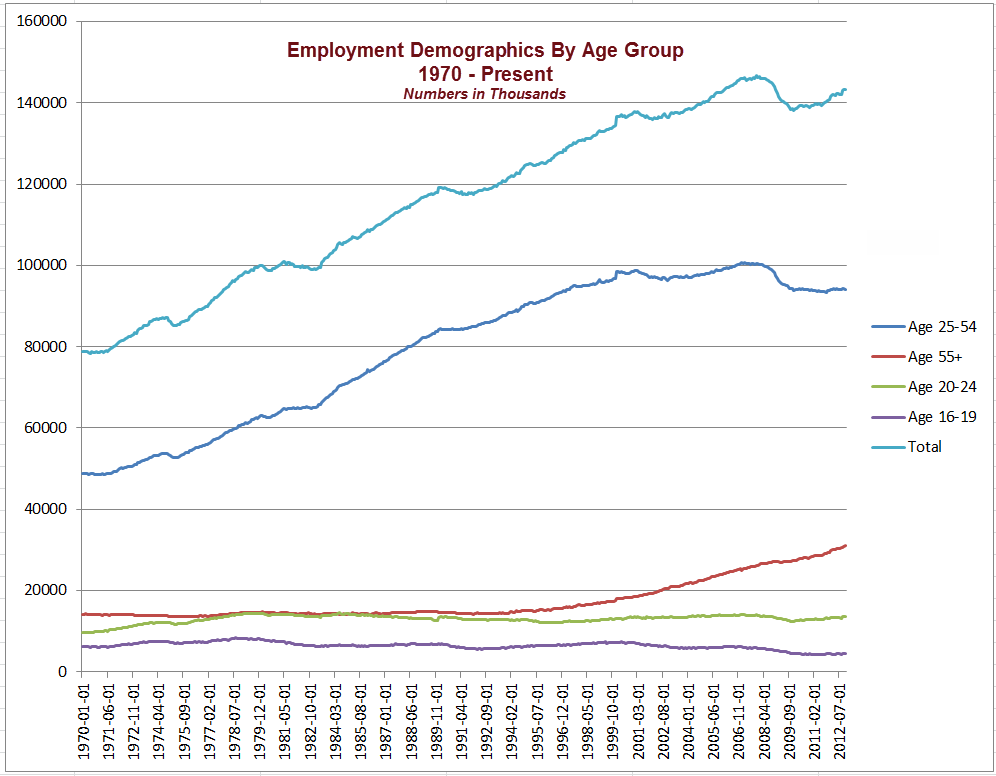

ZeroHedge had an interesting set of charts of BLS data in his post Number Of Workers Aged 25-54 Back To April 1997 Levels.

I picked up on that theme and put together this chart of BLS data showing various age groups.

http://3.bp.blogspot.com/-ZBStWRJbCQo/UMJVWTnpicI/AAAAAAAATC4/E90C_v7grBw/s1600/...Demographic Points of Note

http://3.bp.blogspot.com/-ZBStWRJbCQo/UMJVWTnpicI/AAAAAAAATC4/E90C_v7grBw/s1600/...Demographic Points of Note•Employment in age group 25-54 is 94,063,000

•Employment in age group 25-54 was 94,167,000 in April 1997

•Total employment is 143,257,000

•Total employment was 143,449,000 in February 2006

•The low employment for age group 25-54 was 93,356,000 in October 2011, 28 months after the recovery began

•Total employment at the start of the recovery in June 2009 was 140,074,000

•Age 55 and up employment at the start of the recovery was 27,105,000

•Age 25-54 employment at the start of the recovery was 95,264,000

•Age 55 and up employment is now 31,119,000

•Age 25-54 employment is now 94,063,000

Reflections on the Recovery•Since the start of the recovery, the economy added 3,183,000 total jobs

•Since the start of the recovery, the economy added 4,014,000 jobs in age group 55+

•Since the start of the recovery, the economy lost 831,000 jobs of those between 16-54

•Since the start of the recovery, the economy lost 1,201,000 jobs of those between 25-54

Boomer demographics certainly explains "some" of this trend.

For the rest of the trend, consider my comment in today's job report: Establishment Survey +146,000; Household Survey -122,000 Jobs; Unemployment 7.7% as Labor Force Shrinks by 350,000

In the last year, the civilian noninstitutional population rose by 3,733,000. Yet the labor force only rose by 1,354,000.

Those "not" in the labor force rose by 2,380,000 to 88,883,000.

The massive rise of those "not" in the labor force is primarily economic weakness, not demographics.

Actually, older workers are returning to the work force because they cannot afford retirement. One look at the average age of Walmart greeters and those working in fast food restaurants tells a story itself.Flashback May, 1 2008

For point of record, consider what I said on May 1, 2008 in Demographics Of Jobless Claims

Ironically, older part-time workers remaining in or reentering the labor force will be cheaper to hire in many cases than younger workers. The reason is Boomers 65 and older will be covered by Medicare (as long as it lasts) and will not require as many benefits as will younger workers, especially those with families. In effect, Boomers will be competing with their children and grandchildren for jobs that in many cases do not pay living wages.Link -

http://globaleconomicanalysis.blogspot.com.au/2012/12/startling-look-at-job-demo...========================================

Just a few thoughts -

1) In roughly 3.5 years, since June 2009 the 55 & over Employment has risen by just over million, whilst the 25-54 employment Declined by around 1.2 million.

2) On average, there are some 4 million US Baby Boomers entering that over 55 year bracket, each year.

3) If we apply say a 60% Employment participation rate, then around 2.4 million Employed Boomers should be coming into the over 55 year bracket, each year.

4) Therefore, over a 3.5 year period, the additional Boomers coming into the over 55 Employed bracket should have been around 8.4 million, given the usual Participation rate, BUT the actual increase in Employed over 55 year olds was only 1.2 million.

5) So, whilst there has been a BUMP attributable to the Baby Boomers HUMPFEST, the BUMP does not seem to be as big a BUMP, as the original HUMPFEST would suggest it should have been!

6) Of course, you would still need to take into consideration those numbers from the generation prior to the Baby Boomers, the so called "Silent Generation". However, as would be anticipated from the term Baby Boomers, the Silent generation numbers were considerably less.

7) Finally, it would seem apparent that both Demographics & the Resultant Economics are involved in both the Employment & Unemployment trends, with less jobs being available because of those factors, BUT an extra LARGE number of Boomers leaving the workforce because of reaching their Reitrement age, thus lowering the Participation rate & keeping the Unemployment rate from exploding.

8) If the figures were available, I would suggest they would be similar in OZ!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: