Problems in Italy Go On (and On and On); Coalition on Verge of Collapse, Every Economic Statistic Heads Wrong Way

With a fragile coalition that is barely hanging on by a thread, a new battle over tax hikes and a stick it to the rich mentality is about to set in.

Needing revenue to meet its budget deficit targets, Italy's Finance Undersecretary Says Budget Crunch May Require More From Rich.

Italian Finance Undersecretary Pier Paolo Baretta said the government is considering shifting the tax burden to the wealthy in order to satisfy demands for broad-based fiscal easing and meet its 2013 deficit target.

“The truth is we’ve got a real bottleneck of issues to deal with” this year, Baretta said yesterday in an interview in his office in Rome. In order to raise funds, Italy is seeking spending cuts and may limit the tax deductions higher-income households take on medical visits and other expenses, he said.

Prime Minister Enrico Letta is bracing for a tax-policy showdown that threatens to destabilize his two-month-old parliamentary coalition.

Silvio Berlusconi, the three-time premier and a partner in Letta’s coalition, has pushed for the abolition of property taxes on primary residences, which would cost the state about 4 billion euros annually. Other members of the coalition have called for the cancellation of an increase to the value-added tax planned for Oct. 1. Postponing the VAT increase by three months would cost the government about 1 billion euros.

Italy's Parliament Shut Down By Berlusconi Over Court RulingThe Huffington Post reports Italy's Parliament Shut Down By Berlusconi's People Of Freedom Party Over Court Ruling

Silvio Berlusconi's party boycotted a summit of Italy's fragile coalition government and blocked parliamentary activity on Wednesday in protest against a supreme court decision to fast track a ruling that could ban him from public office.

The court decision has aggravated tension in the squabbling coalition which was already under fire for the slow pace of reforms desperately needed to boost recovery from the worst recession since World War Two.

Beppe Grillo, leader of the populist 5-Star Movement which stunned Italy by winning an unprecedented quarter of the vote in a February election, said Italy was heading for catastrophe because of the government's failure to take extraordinary measures to tackle the economy.

He said Italy was like a pressure cooker "on the verge of blowing up" and called on President Giorgio Napolitano to call an election as soon as possible.

Every Economic Statistic Heads Wrong WayThe Globe and Mail reports In Italy, desperation as every statistic heads the wrong way.

In the past two quarters, for instance, hirings in Greece have exceeded firings, even though the economy remains in recession. French manufacturing has apparently stopped contracting and Spanish unemployment, the highest in the Western World, has fallen a bit.

The exception is Italy. Almost every number is going in the wrong direction and a sense of desperation is hitting everyone from retailers and cabinet ministers, who have gone begging to the European Union for job-creation funds, to consumers and manufacturers, whose factory output has fallen by a quarter since the European crisis started in 2008.

Italy matters because it is the euro zone’s third-biggest economy, with a gross domestic product about 20 per cent bigger than Canada’s. Its national debt load, at €2-trillion ($2.7-trillion), is Europe’s biggest. Jobs are vanishing by the minute. Youth unemployment is 40 per cent; it’s 50 per cent in southern Italy, to the delight of crime syndicate recruiters. Confederscenti, the Italian retailers’ association, says that three shops close for every one opening.

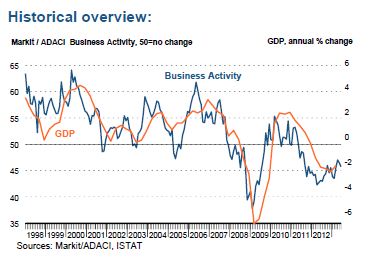

Italy Services PMIWrapping up this report on Italy let's take a look at the latest Markit/ADACI Italy Services PMI®.

June sees sharpest decrease in business activity for three months

Services PMI Summary:June PMI data signalled accelerated declines in both business activity and employment at Italy’s service providers, while the level of incoming new work in the sector again fell markedly.Business activity in Italy’s service sector decreased at a faster pace in June,

Summary:June PMI data signalled accelerated declines in both business activity and employment at Italy’s service providers, while the level of incoming new work in the sector again fell markedly.Business activity in Italy’s service sector decreased at a faster pace in June, as highlighted by the seasonally adjusted Markit/ADACI Business Activity Index – which is based on a single question asking respondents to report on the actual change in business activity at their companies compared to one month ago – falling further below the 50.0 no change mark, from 46.5 in May to 45.8. This was its lowest reading since March, and one that was indicative of a substantial rate of contraction.

Firms sometimes linked lower output to a lack of incoming new business, which in June fell for the twenty-sixth consecutive month. Although less sharp than in the preceding survey period, the rate of decline in new business was nevertheless still marked relative to the historical standards of the survey.

Link -

http://globaleconomicanalysis.blogspot.com.au/2013/07/problems-in-italy-go-on-an...================================

Good luck, with trying to stick it to the rich?

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: