angeleyes wrote on Jun 19

th, 2012 at 9:24am:

When the EU was formed the rules and regulations weren't followed by certain countries. They are the countries now in strife.

You may find that the EU was aware that some of the countries now in MOST strife, did not meet the initial rules and regulations, to join in the EURO fun, but the EU view was that they couldn't get under way, without the likes of Italy, Spain & to a lesser extent Portugal, so the EU bent their own rules and allowed them in.

The other issue was/is, what these and other countries, including Greece have reported before & after joining the EU and with Greece (in particular), they had the "assistance" of some major banks (including Goldman Sucks), which "may" have "bent" the rules "greatly".

In any event, even those countries whom are supposedly strong, such as Germany, France, the UK & the USA, are far from strong with Debt to GDP ratio's currently around 80%, 90%, 85% & 105% respectively. There are many interpretations & variations on these figures, but the following site may give some indications on current figures, although I would completely disregard their future projections, as they are likely to be worthless, come next year!

http://en.wikipedia.org/wiki/List_of_countries_by_future_gross_government_debt As a comparison, Japan is current around 240% & Greece around 190%, whereas Australian, notwithstanding the usual Political banter, is actually very well placed, at around 20%.

It is worth noting that the country with the greatest Debt to GDP ratio, being Japan, is the country who started the greying of their population some 15 years prior to the rest of the world.

In fact, the Japanese trend is well worth looking at & keeping in mind. Their share market now sits at some 22% of its 1989 peak

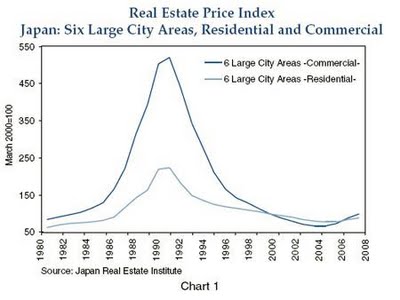

http://au.finance.yahoo.com/echarts?s=^N225#symbol=^n225;range=my;compare=;indic...And, the Japanese real estate market is still a long way under its 1990 peak.

The Japanese trend came largely because of the Aging Demographics and it also came despite a robust world Economy, which had not yet been hit by their own Aging Demographics, nor by Energy Supply shortages, nor by the nastier side of the changes to the Global Climate.

It is therefore safe to surmise that the Global future will be at least on par, if not worse than the post 1990 Japanese experience!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: